What is the financial fallout of the Coronavirus and the lockdowns that are going with it? Before we get into the financial consequences of the Coronavirus, let’s look at the role of gold in keeping an economy stable:

Buying sovereign bonds

Say you’re the newly appointed Finance Minister for the struggling nation of Elbonia (apologies to Scott Adams and the Marx Brothers). Your treasury has a 863 million slogan surplus ($160 million in U.S. money). You want to put that into a good, safe, interest-bearing bond. The Bank of England wants to borrow money to balance its budget. To sweeten the deal, they pledge 4 tonnes of gold as collateral, conveniently kept for you in their own vaults (so you don’t have to worry about a war with neighboring East Weston trying to steal it). You sign the deal and wire-transfer the money.

Along comes Fredonia and wants to lend money to the Bank of England too. Unlike you, they want to have their gold shipped to them. But Bank of England doesn’t have all that much, what with trade deficits and paying for Brexit and such. So they ship your gold to them. They’re pretending to hold your gold for you, but as long as you don’t actually ask for it, everybody’s happy. (And since no one knows differently, you can tell the Elbonian public that their money’s safe and everyone believes it.)

The above sounds a little bit far-fetched, until you realize that banks have hundreds or thousands of depositors and borrowers. Then it’s much more likely. This is a variety of Fractional Reserve Banking, and works just fine as long as everybody doesn’t ask for their money back at the same time. A central bank with only 1% physical gold assets to back the gold on deposit is possible.

Give us our gold, please

In 2013 the German Bundesbank (German Federal Bank) decided to bring 50% of its gold reserves home. It wasn’t so much as a why, but a why not? If the risk of an invasion by the Soviet Union was gone, there was no particular reason to keep it abroad. Unless they wanted to sell some gold for British pounds. Then it would be quicker and more convenient if the Brits could just take some out from the German vaults underneath London, and deposit pounds Sterling in their account. Rumors of central banks holding only a fraction of their deposits in physical gold added a new sense of urgency to the bring it home plan.

From 2013 to 2016, 300 tonnes of gold were repatriated from the Federal Reserve Bank in New York to Germany. If the gold was just sitting there in the vaults, why did it take so long? There are a number of good explanations, but the paranoid view is that the gold wasn’t there. And the FRB had to buy gold, over a period of years, to have something to “return” to Germany.

The gold that Germany got wasn’t the same gold. It had different mint markings, but gold is “fungible”. Meaning you are never guaranteed the same gold back — only the same weight, amount, and purity. Carl-Ludwig Thiele, then a Director of the Bundesbank said “we have nothing to complain about”. It’s like an oil company putting a gallon of crude into the U.S. oil pipeline network. You are given the right to take a gallon out, but it isn’t going to be the same gallon.

No one is talking details about this. But I suspect the deal was “you send us our gold back, within 7 years, and we won’t alarm others with our suspicions”.

As safe as what?

I have heard rumors for years that the U.S. Bullion Depository (by Fort Knox, Kentucky) has no (or little) gold in it. I don’t know, but no one is opening the vaults to reporters (and I suppose even the President would have a tough time getting in). I’ve also heard rumors that the U.S. economy is struggling on the knife-edge of a financial breakdown such as Argentina had in 2001. Again I don’t know.

But it seems that the U.S.A. keeps forestalling the coming financial crisis the only way it can, with economic interventions that work for now, but only by building a even bigger bubble; that will burst like a nuclear bomb when it finally blows. The interventions being done won’t cure anything. They will just “kick the can down the road” so that hopefully, it won’t come for at least a few years yet. But the Coronavirus and the lockdowns that have come with it just may be the load of bricks that breaks the camel’s back.

U.S. President Donald Trump had declared he wants to restart the U.S. economy by Easter. That would have been just 4 days after this article was published. Since then he has changed that to the end of April. And may change that yet again, but the date he gives really means nothing. The Federal government doesn’t decide these things; the individual states do.

Restarting the economy means getting rid of lockdowns and putting everybody back to work. Nice to be able to go out again, enjoy life, work, and get paid for it. But not if the Corona pandemic spikes again. Millions of lives could be lost. Even the U.S. Centers for Disease Control advises against an early end to isolation.

Coronavirus and politics on Trump’s watch

So why would he want to speed things up? I have several theories:

- People are getting tired of the lockdown and an end to it would be popular.

- The medical equipment to fight the virus — like ventilators — are in short supply and no one wants to admit it.

- With the U.S. economy being at risk for years, the stress of shutting the economy down — basically, a manufactured recession — could be the thing that pushes it over the edge into a full-scale meltdown.

- Without a unified policy to fight the disease across all 50 states, restrictions on going out won’t have much of an effect anyway. “Patchwork isolation” just doesn’t work, although at least one state, Florida, has attempted to restrict people entering from other states.

A common phrase in the military is, “at least it didn’t happen on my watch”. This means the bad thing that happened didn’t happen when you were on duty. So you don’t have to take the blame. Even though it was bound to happen anyway, it was just a matter of when.

President Trump doesn’t want the meltdown to happen on his watch — which doesn’t end until January 20, 2021 (unless he’s reelected). He knows that if it happens while he’s President, he’ll take the blame, regardless of any silly Coronavirus. His political survival depends on “kicking the can down the road” just a little bit more.

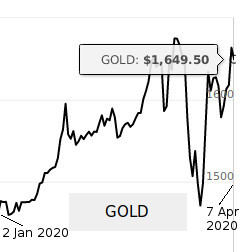

Gold prices are up

Gold prices have shown a lot of variability lately, but the overall trend, I think, will be up. Especially with the coming inflation I’ve predicted, expect gold prices to climb to the moon.

And with economic ties between the U.S.A. and nearly every other nation, the financial consequences of the coronavirus could be a chain reaction that will hurt everyone who is not prepared.